Business Instalment Loans

Status: Available

How It Works

Apply for a financing limit tailored to your business needs through a straightforward application process.

Once approved, withdraw the desired amount from your financing limit and select a suitable repayment plan.

The amount withdrawn is financed through an automated funding exchange, ensuring quick access to funds.

Repay the borrowed amount in monthly instalments. Enjoy the flexibility of making early repayments or withdrawing additional funds as long as there is remaining credit under the financing limit.

Benefits

- Flexible Credit Facility: Access funds as needed without any obligation to utilize the full approved limit, providing flexibility to adapt to business needs.

- Investment and Capital Boost: Utilize the loan to finance important investments or to enhance working capital, supporting your business’s growth and operational needs.

- Data-Driven Credit Limits: Credit limits are determined based on the most recent financial data, utilizing open banking and accounting software integrations for accurate assessments.

- Instant Funding Access: Benefit from a robust funding engine that allows for instant fund withdrawals whenever needed.

- Transparent Pricing: Clear and straightforward pricing structures ensure you understand all costs upfront.

- Flexible Repayment Terms: Repay in structured monthly instalments with the option to adjust the plan by making early repayments or taking additional withdrawals within the credit limit.

Demo Videos

Integration with Neobanks/Banks:

Discover how Business Instalment Loans integrate seamlessly with financial platforms, providing flexibility and ease of use.

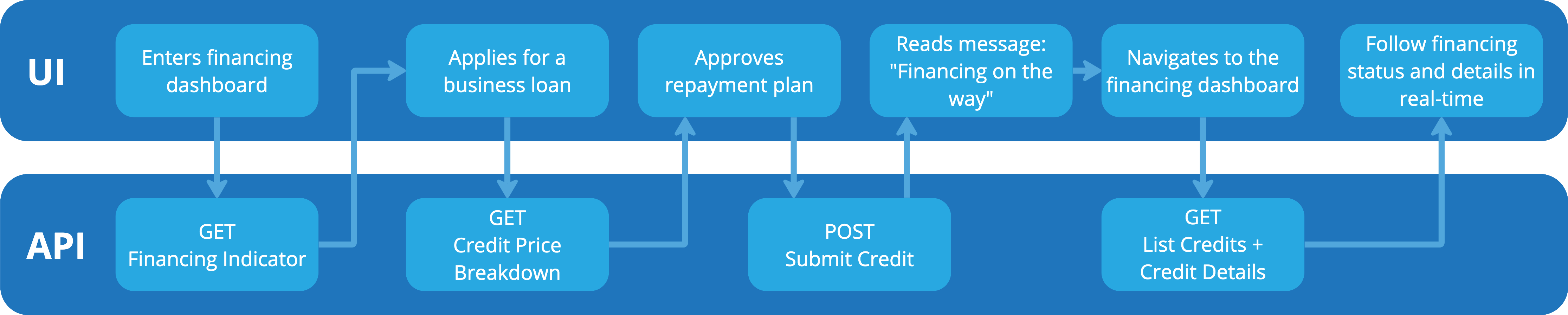

API Diagram

This diagram visually illustrates the integration of Business Instalment Loans within various business financial systems, showcasing the seamless data flow and transaction processes.