Revolving Credit Cards

Status: Coming in Q3/2024

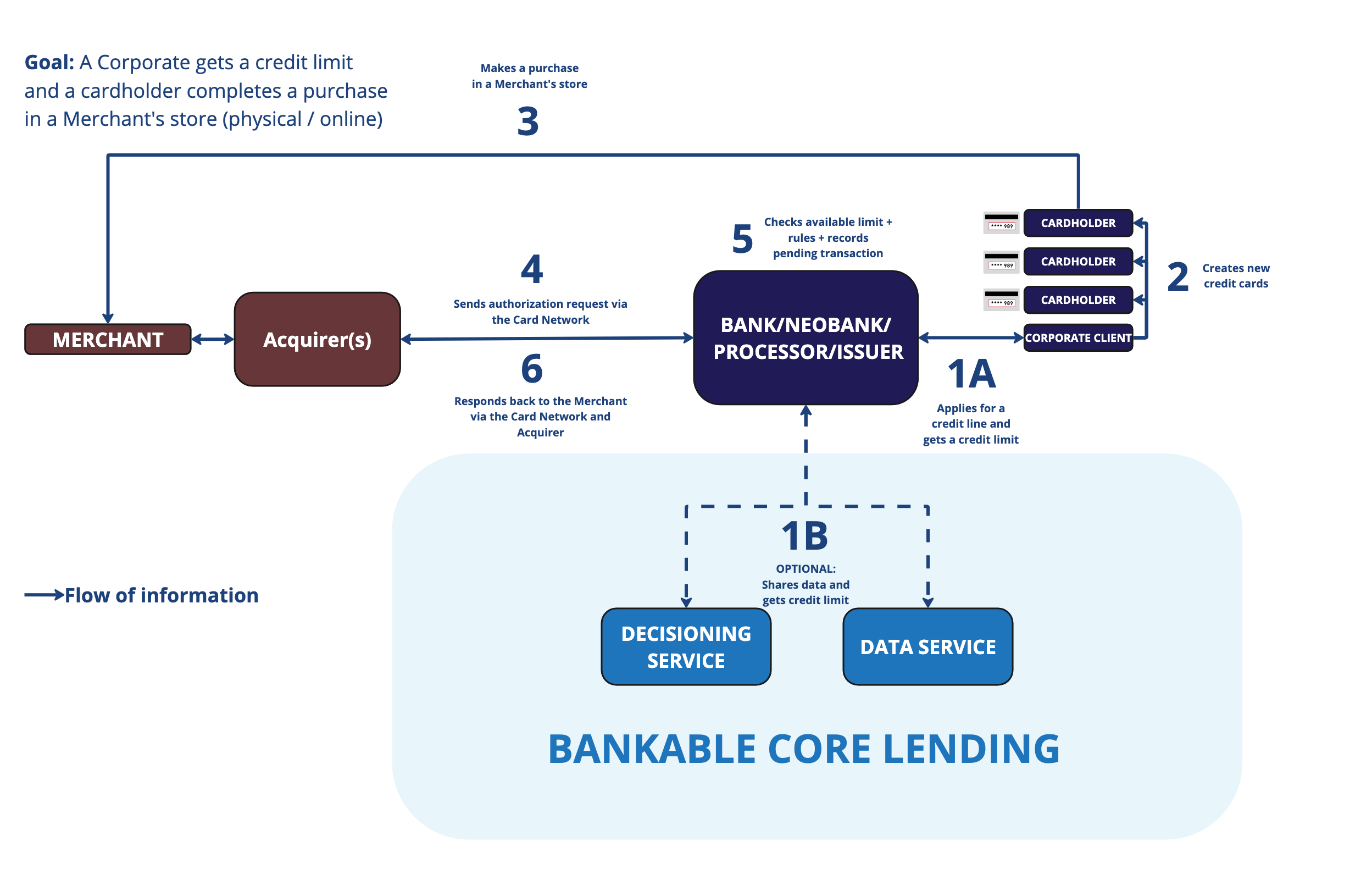

How It Works

Apply for the credit line through a streamlined application process.

Upon approval, create new credit cards for your business and set individual spending limits for each card.

Use the credit line by making withdrawals to an account or by utilizing the credit cards for transactions.

Payments are automatically approved if they are within the available credit limit.

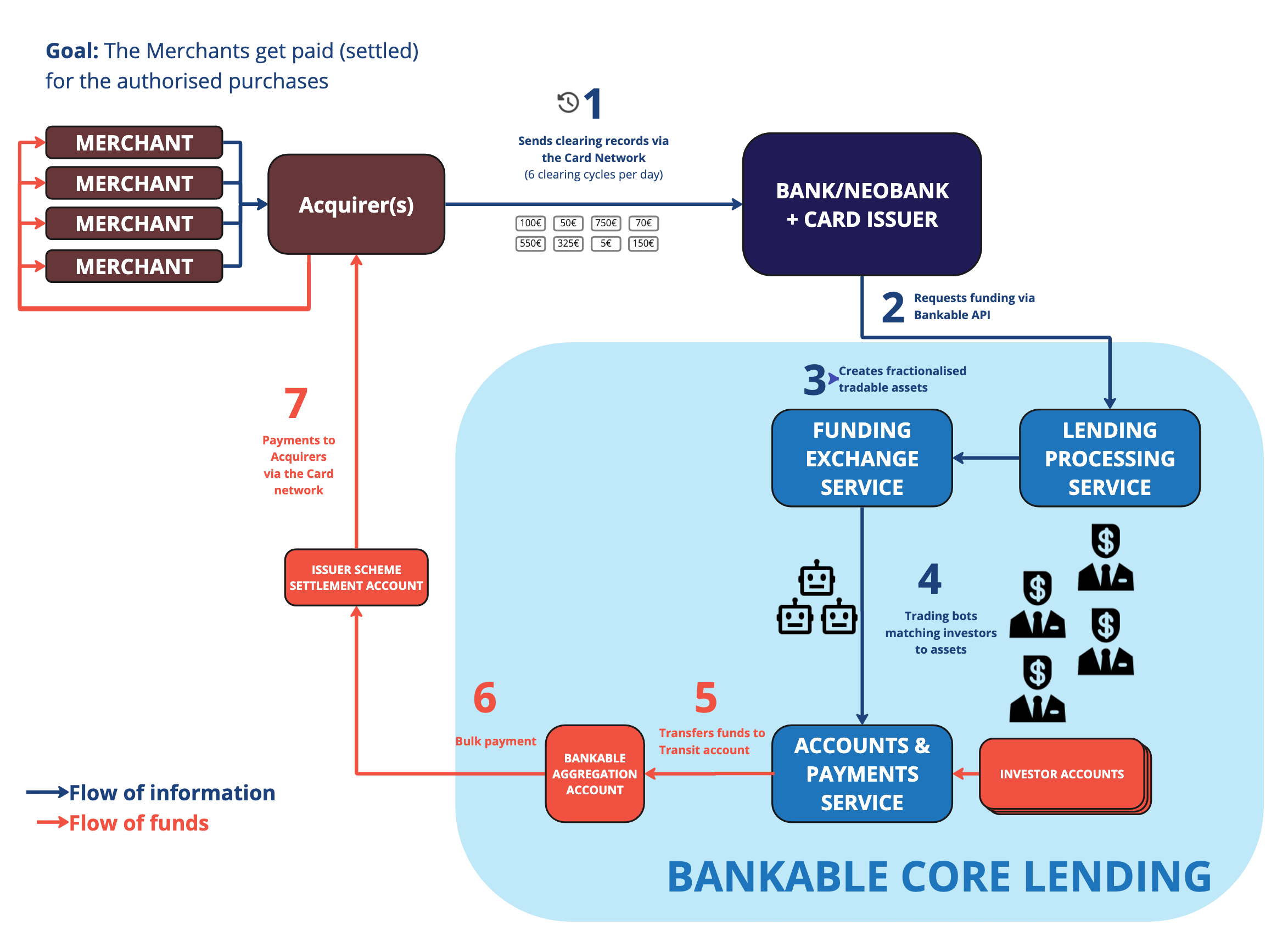

When merchants submit charges for settlement, investors participating in the Bankable Funding Exchange purchase these card transactions as fractionalized tradable assets. Merchants are settled through the card network according to the usual clearing cycle schedule.

Clients have the flexibility to repay the total amount or begin revolving by paying a portion of the outstanding balance. Repayment options include a fixed amount, a percentage of the outstanding balance, or based on revenue.

Benefits

- Flexible Credit Facility: Access a credit line that adapts to your business needs and can be distributed across multiple credit cards.

- Control Over Limits: Assign and adjust credit limits on individual cards, offering flexibility and control over how credit is utilized within your organization.

- Data-Driven Credit Decisions: Credit limits are set based on the most current financial data available through open banking and accounting software integrations, rather than outdated financial statements.

- Robust Funding Engine: Utilize a powerful funding mechanism that finances payments to merchants, ensuring fluid transaction processing.

- Seamless Integration: Keep the limits and transactions always up-to-date by real-time integration data.

- Transparent Pricing: Enjoy clear and straightforward pricing structures without - Flexible Repayment Options: Choose from various repayment strategies that best suit your financial situation, whether paying in full or utilizing revolving credit options.

Demo Videos

Integration with Neobanks/Banks

Explore how Revolving Credit Lines and Credit Cards integrate with banking platforms, providing detailed insights into functionality and benefits for financial institutions.

API Diagram

This diagram illustrates how the Revolving Credit Cards solution integrates within business financial systems, showcasing the efficient flow of data and transactions through automated processes.