NextGen Debtor Book Financing

Status: Coming in Q3/2024

How It Works

Connect your accounting software to our platform to establish a maximum financing limit, calculated based on up-to-date financial data.

Choose the desired percentage of financing up to the maximum limit, with the flexibility to adjust this percentage at any time based on your current cash flow needs.

Complete a quick automated onboarding process to sign a financing agreement, which is required only once at the initiation of the first financing.

Investors participating in the Bankable Funding Exchange will purchase your invoice receivables on a daily basis, providing you with funding up to the chosen percentage of the receivables each day.

As your clients repay their invoices, the remaining portion of the receivable is released back to you.

Benefits

- Flexible Credit Facility: Adjust the percentage of your receivables financed at any time to suit your changing cash flow needs.

- Cost-Effective Financing: Utilize your receivables as collateral, which helps to reduce financing costs due to lowered risk.

- Data-Driven Credit Limits: Credit limits are dynamically calculated based on the most recent financial data obtained through open banking and accounting software integrations.

- Automated Invoice Financing: Eliminate manual work and streamline cash flow with automated financing of invoices on a daily basis.

- Transparent Pricing: Benefit from transparent pricing with a consistent rate applied across all invoices, calculated based on average risk.

- Automated Reconciliation: Enjoy seamless payment matching and accounting reconciliation integrated into your financial operations.

Demo Videos

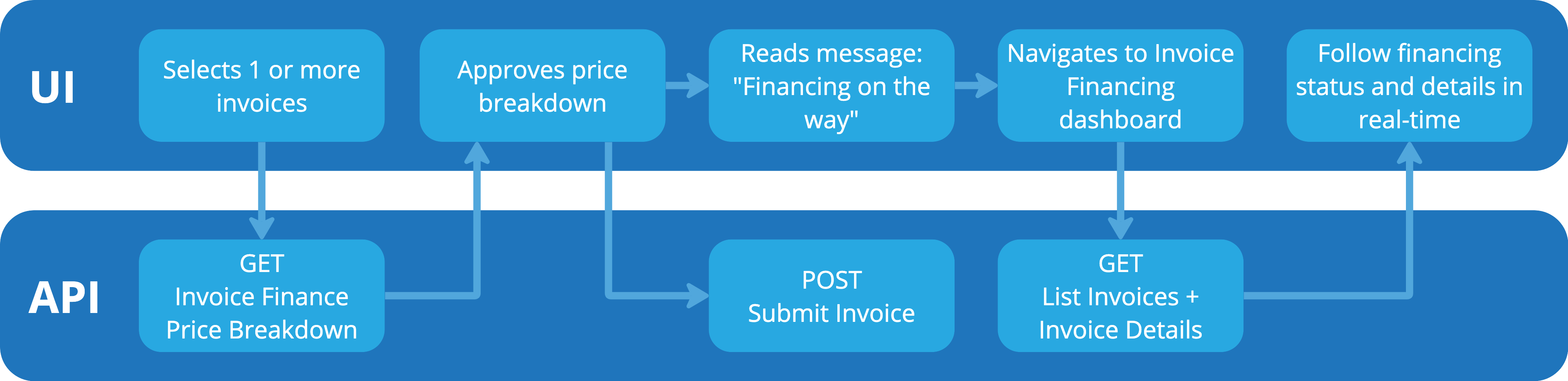

API Diagram

This diagram illustrates how Debtor Book Financing integrates within business financial systems, showcasing the efficient flow of data and transactions through automated processes.