Invoice Receivables Financing

Product Status: Available

How It Works

Choose one or more invoices for financing directly in the interface where you normally process your invoices.

Approve the pricing and the amount you will receive after approval

Investors participating in the Bankable Funding Exchange will buy the invoices using automated trading bots that match invoices to investor strategies.

Receive funds minus fees and deposit within 24 hours.

When your debtor pays the invoice, receive the remaining deposit (ranging from 0-20% of the invoice face value).

Benefits

- Rapid Funding: Funds are typically received within 24 hours, reducing debtor days to zero.

- Flexible Financing: No minimum commitment or maximum limit, finance on demand to suit your cash flow needs.

- Risk Options: Choose from non-recourse financing, where the non-payment risk is transferred to the investors, or recourse financing, where you cover non-payments.

- Transparent Pricing: Access transparent pricing details which you can review and approve before requesting financing.

- Real-Time Tracking: Maintain real-time access to financing status and details like pricing through our client portal.

Product Demos

Bankable White-Labelled UI

Discover how easy it is to manage invoice financing through our tailored user interface designed for simplicity and efficiency.

Integration with Accounting Tech/ERP Systems

See how seamlessly our service integrates with various accounting technologies and ERP systems to streamline your financial operations and enhance the financial management.

Low-Code solution

Learn how our revolutionary low-code solution allows you to add our receivables financing solution into your digital channel in days, not weeks.

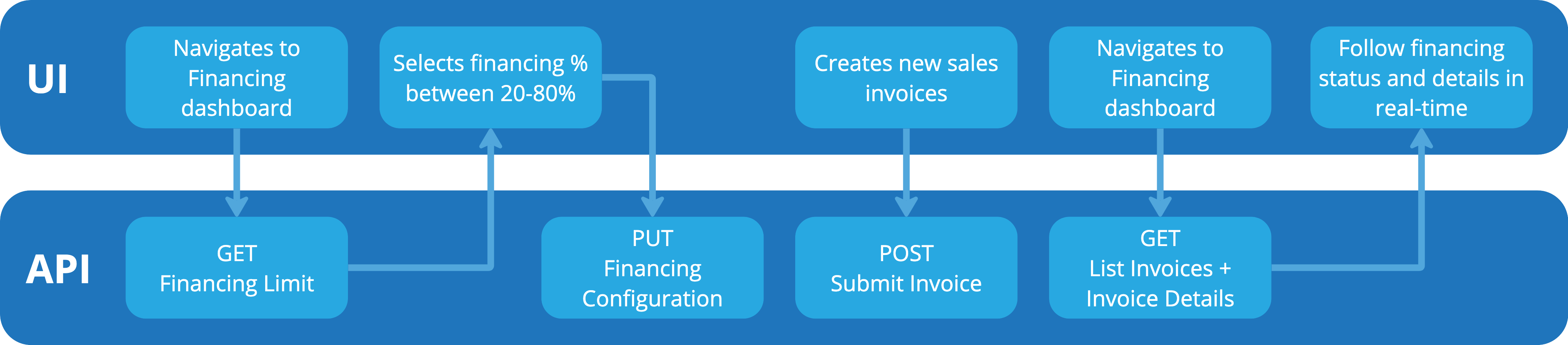

API Diagram

This diagram provides a high-level overview of how the Invoice Receivable Financing integrates with your systems, showing the user journey and API interactions that support seamless service implementation.