Buy Now, Pay Later (BNPL)

Status: Coming in Q3/2024

How It Works

Clients see the financing option directly on the product page if they are pre-eligible, allowing them to consider their payment options early in the shopping process.

Clients choose a repayment plan that suits their financial situation, with options ranging from weekly to monthly installments up to one year.

Quick automated onboarding process to sign a financing agreement, required only once for the first time a client uses the service.

Investors participating in the Bankable Funding Exchange will purchase these transactions using automated trading bots that align purchase financing with investor strategies.

E-commerce businesses receive the payment within 24 hours of the purchase, ensuring they are not impacted by the deferred payment terms.

Clients repay in agreed instalments, maintaining flexibility in their financial planning.

Benefits

- Fast Payment to E-commerce: E-commerce businesses are paid within 24 hours, ensuring their cash flow remains uninterrupted.

- Single Sign-On Financing: Clients sign the financing contract only once, and the BNPL option remains available for future purchases up to their credit limit.

- Dynamic Credit Assessment: Credit limits are dynamically adjusted based on recent financial data obtained through open banking and accounting integrations, rather than relying on outdated financial statements.

- Integrated Financing Solutions: Combine BNPL with invoice receivable financing to offer comprehensive payment solutions that include pay-by-invoice options with flexible terms.

- Transparent Pricing: Clients can review and approve transparent pricing details before committing to financing, ensuring full understanding and acceptance of the terms.

- Flexible Repayment Adjustments: Clients can adjust their repayment plans as their financial circumstances change, with options for early repayment to save on interest costs.

Demo Videos

E-commerce BNPL B2B

Explore how the BNPL solution is tailored for B2B e-commerce environments, demonstrating the ease of integration and the benefits for both sellers and buyers.

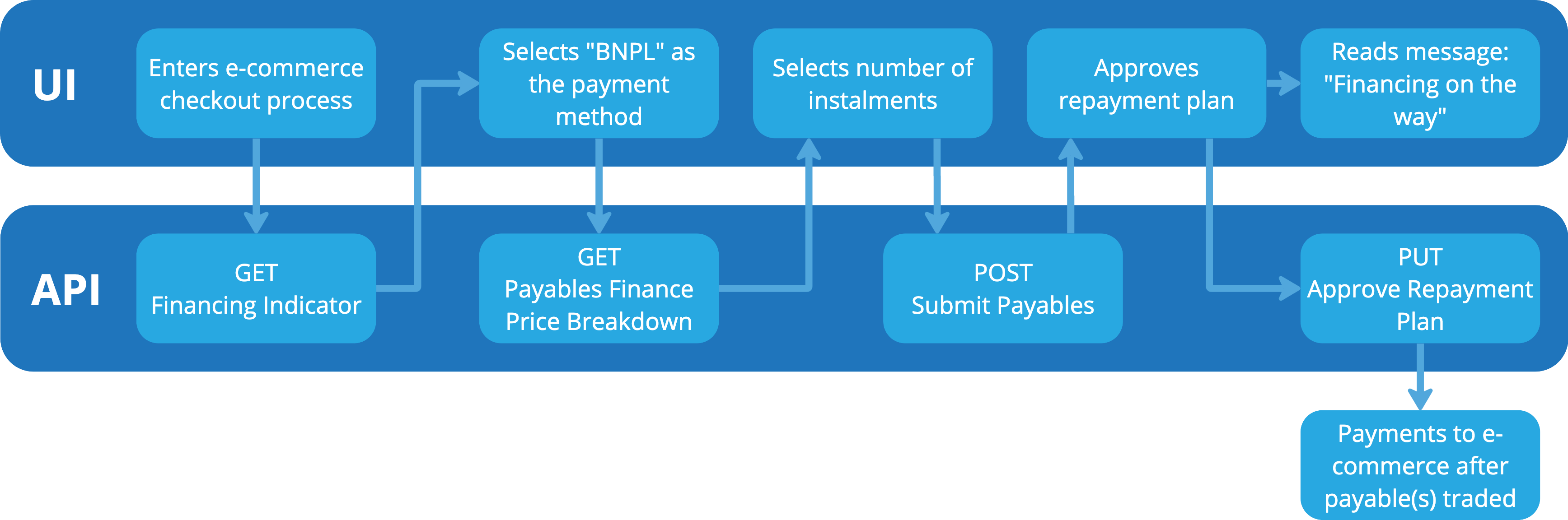

API Diagram

This diagram provides a visual overview of how the BNPL solution integrates with e-commerce platforms and the Bankable Funding Exchange, illustrating the seamless flow of data and transactions.