Supplier Financing

Status: Coming in Q3/2024

How It Works

A client receives an invoice from their supplier and verifies if the invoice is eligible for financing.

The client decides whether they or their supplier should cover the financing fees, offering flexibility in financial management.

The supplier agrees to the financing terms and opts into the program.

Investors participating in the Bankable Funding Exchange purchase the invoice using automated trading bots that match the invoice with appropriate investor strategies.

The supplier receives payment within 24 hours, ensuring they have immediate access to funds.

The client repays the financed amount according to the agreed-upon terms, which can extend up to 180 days.

Benefits to SMEs

- Rapid Payment to Suppliers: Suppliers receive payments within 24 hours, enhancing their liquidity and trust in your clients.

- Single Contract Sign-On: Clients sign the financing contract only once, and the financing option remains continually available up to their approved credit limit.

- Data-Driven Credit Limits: Credit limits are set based on recent financial data sourced through open banking and accounting integrations, offering more accurate and timely financial assessments.

- Integrated Financial Management: Combine this product with invoice payables financing to provide a comprehensive financial solution that includes flexible repayments options such as weekly or monthly installments.

- Transparent Pricing: Clients can review and approve all financing costs upfront, ensuring transparency and satisfaction with the terms.

- Choice of Fee Payment: Provides the flexibility for clients or suppliers to decide who pays the financing fees, or an option to share these costs.

- Adaptable Repayment Plans: Clients experiencing payment difficulties can switch to an instalment repayment plan, adding an extra layer of financial security and adaptability.

Demo Videos

Spend Management Software Integration

Explore how Supplier Invoice Finance seamlessly integrates into spend management software, simplifying the process for businesses to manage their supplier payments.

[coming soon]

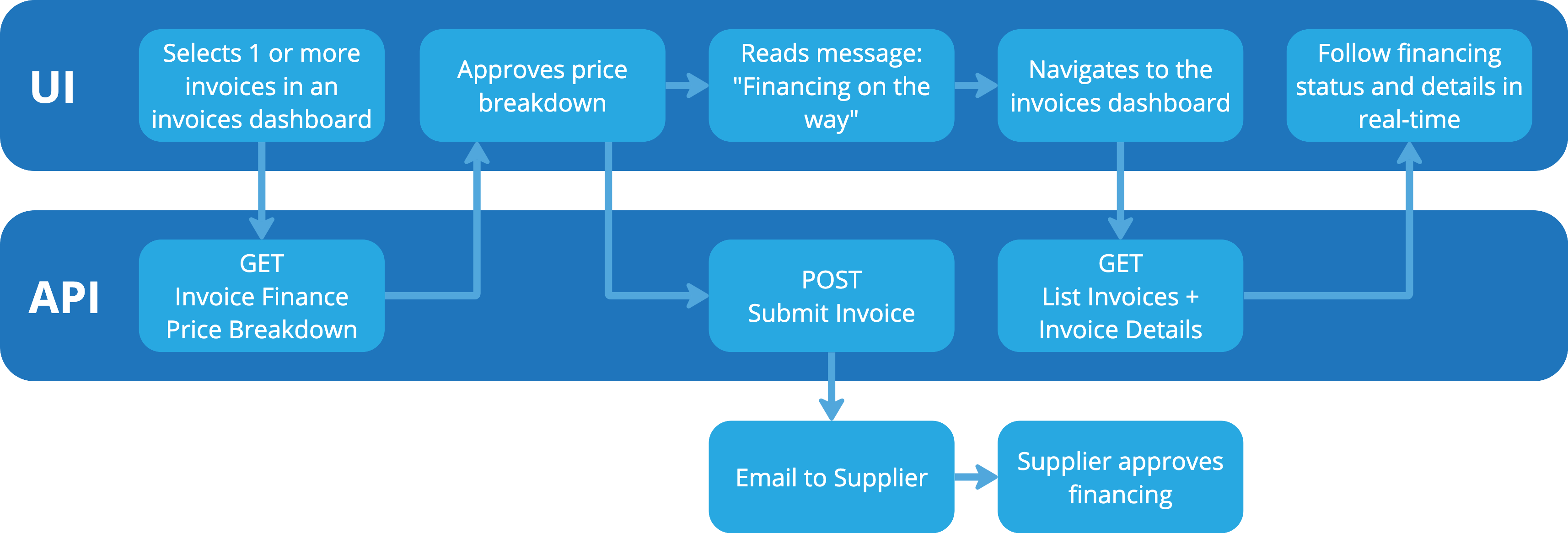

API Diagram

This diagram provides a visual overview of how Supplier Invoice Finance integrates with business systems, illustrating the streamlined flow of data and transactions through the platform.